Manufacturers associations such as the National Association of Manufacturing (NAM) have been wary or hostile to imports, but recognize that for U.S. firms to succeed in world markets they have to compete successfully with foreign firms.

An alternative to tariff barriers, or subsidies for U.S. manufacturers, is to review and where possible reduce regulatory costs here at home. When debaters (or politicians) call for restricting imports to “bring back American jobs,” negatives can counter that reducing regulations at home would enable U.S. firms to be succeed in more industries at home and overseas.

The costs imposed by excess regulations are a significant burden according to NAM:

The costs imposed by excess regulations are a significant burden according to NAM:

Manufacturers are the backbone of our nation’s economy and employ more than 12 million men and women who make things in America. To maintain manufacturing momentum and encourage hiring, the United States needs government policies more attuned to the realities of global competition. Our regulatory system produces unnecessarily costly rules, duplicative mandates, impediments to innovation and barriers to our international competitiveness. Despite many initiatives and efforts to reduce the unnecessary regulatory cost imposed on businesses, the cumulative regulatory burden continues to expand.

The new NAM study (pdf) reviews financial impacts, which heavily impact smaller firms:

The new NAM study (pdf) reviews financial impacts, which heavily impact smaller firms:

The study also reveals the extent to which manufacturers bear a disproportionate share of the regulatory burden, and that burden is heaviest on small manufacturers because their compliance costs are often not affected by economies of scale. The analysis finds that the average U.S. company pays $9,991 per employee per year to comply with federal regulations. The average manufacturer in the United States pays nearly double that amount—$19,564 per employee per year. Small manufacturers, or those with fewer than 50 employees, incur regulatory costs of $34,671 per employee per year. This is more than three times the cost borne by the average U.S. company

Recent posts for a past policy topic on federal court system reform discuss books and studies on the historical and current debate over liberty of contract. For US/China policy debaters, the key issue is the regulatory burden on U.S. manufacturers which raises costs and reduces manufacturing flexibility. (Especially those regulations that raise costs without protecting consumers, workers, or the environment.)

Should it matter to state and federal judges whether the stated goals of the regulations have some reasonable justification, such as public safety? When Uber drivers contract with Uber and with Uber customers to give people rides, should city or state regulators be able to outlaw or rewrite those contracts? China’s heavy-handed regulation of ride-sharing played a role in Uber giving up and selling its China operations to a competitor. But expensive ongoing battles with state and local regulators in the U.S. also left Uber with less flexibility to absorb losses overseas. “State approves sweeping new regulations for Uber, Lyft but delays rules on leased vehicles,” (Examiner, April 25, 2017) reports:

The California Public Utilities Commission, which regulates what it calls Transportation Network Companies like Uber and Lyft, passed myriad new regulations Thursday, from rules as small as where the pink mustaches on cars should go to as sweeping as stricter vehicle inspections.

A July 14, 2015 re/code headline reads: “Uber Could Have to Pay an Additional $209 Million to Reclassify Its Drivers in California.” That cost to Uber would be passed on to rideshare customers who would pay higher fares, and to drivers who would earn less, plus the the value of Uber the enterprise would be reduced by these new labor regulations. Already Uber is spending millions of dollars to defend its ability to operate as it hires extra lawyers, lobbyists, and public relations consultants.

Uber and Lyft are service companies rather than manufacturers, so don’t face direct competition from Chinese and other overseas manufacturers. Thousands of U.S. manufacturers though do struggle with regulations as they try to compete with international firms. Higher labor costs are one issue, but U.S. workers are usually much more productive, so their higher wages don’t make U.S. firms less competitive.

Work rules however, can be an issue. U.S. firms have product development cycles that can require work long hours during crunch times (and less hours before and after). Should employees be allowed “comp time” for long hours, or should state and federal regulations mandate time-and-a-half for extra hours? Are start-up entrepreneurs and enterprises in the U.S. burdened by the same labor regulations designed for large manufacturers?

Regulatory costs to Uber and Uber customers are similar to thousands of other regulations laced across the economy. The estimated total: $2,000,000,000,000 a year! (two trillion dollars), according to studies on regulatory costs.

Liberty of Contract: Rediscovering a Lost Constitutional Right looks at the justice arguments for the court system to defend liberty of contract from special interest legislation. The natural rights claim is that people’s life, liberty, and pursuit of happiness ought not be infringed by government. But thousands of state and federal regulations, the book claims, have li ttle current safety rationale.

ttle current safety rationale.

In the Competitive Enterprise Institute’s Ten Thousand Commandments 2015: An Annual Snapshot of the Federal Regulatory State, Clyde Wayne Crews collects the data from regulatory studies and federal publications. From the summary:

The scope of federal government spending, deficits and the national debt is staggering, but so is the impact of federal regulations, which now exceeds half the amount the federal government spends annually. Unfortunately, regulations get too little attention in policy debates because, unlike taxes, they are unbudgeted. They are also difficult to quantify because their effects are often indirect. In Ten Thousand Commandments, Crews compiles available data on regulatory costs and trends. By making the size, extent and cost of Washington’s rules and mandates more comprehensible, Crews underscores the need for more review, transparency and accountability—for both new and existing federal regulations.

The 2016 Ten Thousands Commandments report is here.

This research shouldn’t be seen a “greedy” corporations just trying to evade costly regulations. Public choice economists argue that most regulations are promoted by businesses and industry associations as protection against competition or litigation. This is known as regulatory capture theory.

Ideally, Congress would escape the embrace of business, labor, environmental, and other interest groups, and reduce or eliminate regulations that raise costs without delivering safety or other benefits.

To some extent judicial restraint arguments encourage the federal court system to defer to Congress as it passes both helpful and harmful legislation. But judicial engagement advocates argue the court should step in to block regulations that interfere with use of private property and otherwise lawful liberty of contracts.

The National Association of Manufacturers also publishes a study of the cost of excess regulations (page has link to full study:

The National Association of Manufacturers also publishes a study of the cost of excess regulations (page has link to full study:

The National Association of Manufacturers (NAM) has issued a report that shows the macroeconomic impact of federal regulations. The study also reveals the extent to which manufacturers bear a disproportionate share of the regulatory burden, and that burden is heaviest on small businesses and manufacturers because their compliance costs are often not affected by economies of scale.

Alas, the same holds for external pressures. In particular, it is not the case, as OMB has proclaimed, that “businesses generally are not in favor of regulation.”

Free enterprise capitalism is a different political system from a mixed economy where regulatory favors are readily available.

Business not only generally favors regulation, but often sought regulation in the first place (Nobel laureate George Stigler said that in 1971 and explained “regulatory capture” in an article called “The Theory of Economic Regulation.”)

And Crew notes:

Also important: Just as economic regulatory agencies are captured by special interests, much of what is considered social or health/safety or environmental regulation may self-interested rather than public-spirited. Even when regulation “works,” the overall or societal benefits can be outweighed by costs; also the social calculus approach to “net” benefits can ignore wealth transfers, property takings and due process.

American enterprises that hurt customers, endanger employees, or pollute air and water should face legal challenges and be forced to pay for damages. Regulations that raise costs without protecting consumers, employees, or the environment end up reducing jobs, lowering wages, and raise costs for consumers.

What are the claimed costs of excess regulations? According the CEI’s 2016 10KC report:

The federal regulatory cost reached $1.885 trillion in 2015.

Federal regulation is a hidden tax that amounts to nearly $15,000 per U.S. household each year. …

Many Americans complain about taxes, but regulatory compliance costs exceed the $1.82 trillion that the IRS is expected to collect in both individual and corporate income taxes from 2015. …

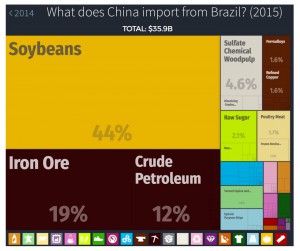

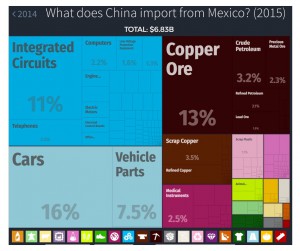

tin America (Argentina and Columbia are next largest), so not surprisingly Brazil and Mexico export the most to China each year. At right

tin America (Argentina and Columbia are next largest), so not surprisingly Brazil and Mexico export the most to China each year. At right As with China, India, Indonesia, Southeast Asia, and much of Africa, Latin Americans have prospered over the last decade. Mexico’s economy didn’t match Brazil’s expansion until the last few years when political scandals disrupted Brazil, and Mexico got on track. “

As with China, India, Indonesia, Southeast Asia, and much of Africa, Latin Americans have prospered over the last decade. Mexico’s economy didn’t match Brazil’s expansion until the last few years when political scandals disrupted Brazil, and Mexico got on track. “ In “

In “

o start many new cities because there is an enormous, unmet demand for city life.

o start many new cities because there is an enormous, unmet demand for city life.

Last week I purchased a fire pit for a friend. It was $125 delivered by Amazon…from China. Should I have instead have tried to purchase a similar fire pit made in the U.S.A.? Well, money was an issue. “Fire Pit” wasn’t in my April budget nor in my friend’s budget. We could have dug a hole in the yard and lined it with bricks. But a portable fire pit for the patio seemed preferable.

Last week I purchased a fire pit for a friend. It was $125 delivered by Amazon…from China. Should I have instead have tried to purchase a similar fire pit made in the U.S.A.? Well, money was an issue. “Fire Pit” wasn’t in my April budget nor in my friend’s budget. We could have dug a hole in the yard and lined it with bricks. But a portable fire pit for the patio seemed preferable. Who is hurt when Americans buy portable fire pits or other products from China? People in China purchase iPhones and other name- brand goods from the U.S. Japan, and Europe and buy food from Kentucky Fried Chicken, Starbucks, and McDonalds. “

Who is hurt when Americans buy portable fire pits or other products from China? People in China purchase iPhones and other name- brand goods from the U.S. Japan, and Europe and buy food from Kentucky Fried Chicken, Starbucks, and McDonalds. “

Electric cars offer many advantages, but reducing pollution isn’t always one of them. Instead, electric cars shift the point of pollution to the electricity source. So electric cars charged in the Pacific Northwest draw power from very clean hydroelectric dams. Electric cars in California can require importing more power from coal burning plants in other states.

Electric cars offer many advantages, but reducing pollution isn’t always one of them. Instead, electric cars shift the point of pollution to the electricity source. So electric cars charged in the Pacific Northwest draw power from very clean hydroelectric dams. Electric cars in California can require importing more power from coal burning plants in other states. Cowen, a frequent visitor to China, is a well-known free-market-oriented professor of economics at George Mason University in Fairfax, Virginia, near Washington, D.C. His book – The Complacent Class: The Self-Defeating Quest for the American Dream – has provoked widespread discussion and has been reviewed and analyzed in all the leading newspapers and policy journals.

Cowen, a frequent visitor to China, is a well-known free-market-oriented professor of economics at George Mason University in Fairfax, Virginia, near Washington, D.C. His book – The Complacent Class: The Self-Defeating Quest for the American Dream – has provoked widespread discussion and has been reviewed and analyzed in all the leading newspapers and policy journals. arginalRevolution blog

arginalRevolution blog